26+ mortgage points deduction

Ad Ready To Apply. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Wetewmzo80kakm

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

. Web Yes you can deduct points for your main home if all of the following conditions apply. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Well help you every step of the way via our new online application.

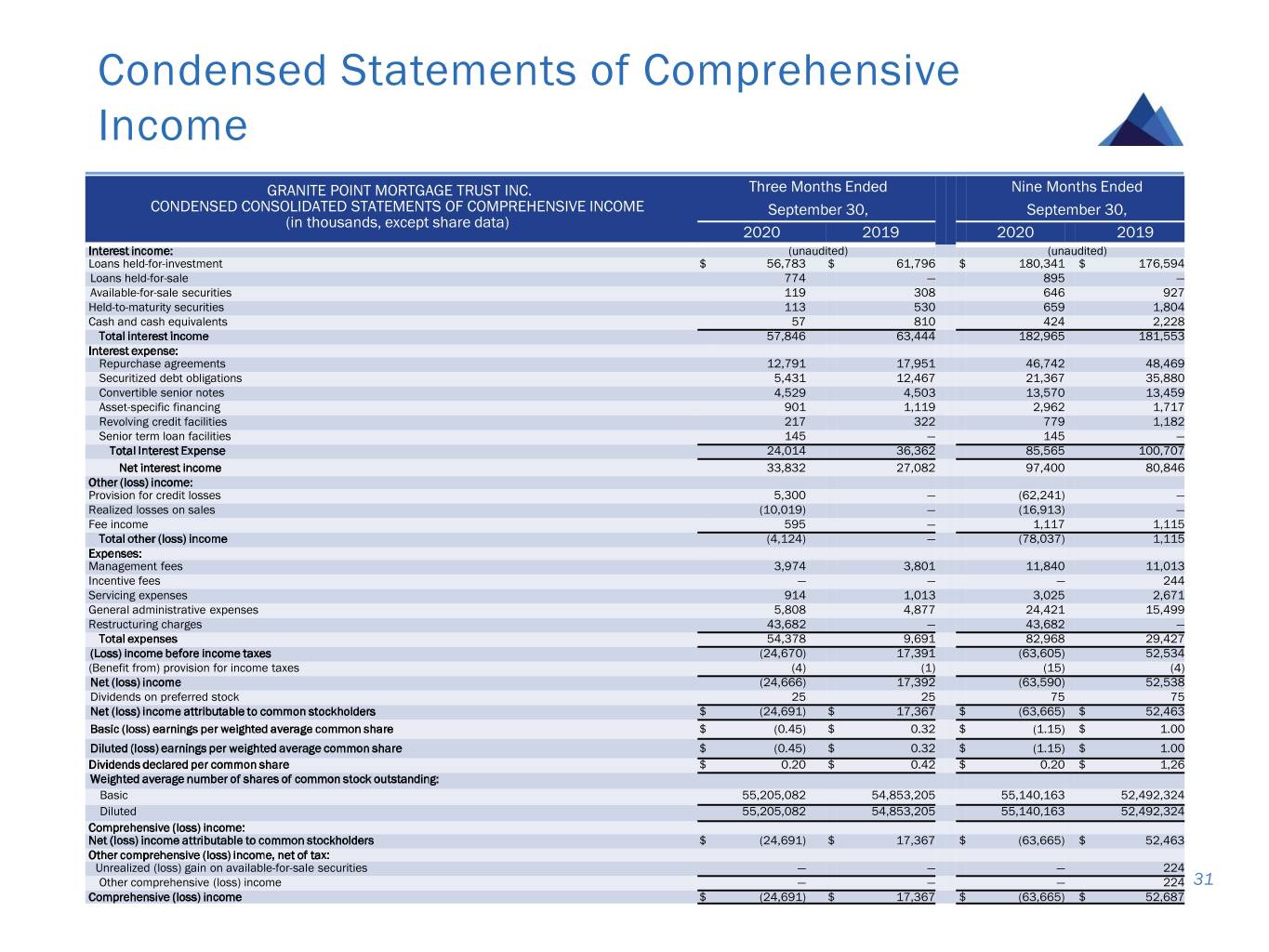

Web Generally the IRS allows you to deduct the full amount of your points in the year you pay them. Web Are mortgage points tax-deductible. If the amount you borrow to buy your home exceeds 750000 million.

Mortgage Ending Early If you again refinance the loan. That reduced rate can mean a good amount of savings on a. Homeowners who bought houses before.

Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. However higher limitations 1 million 500000 if.

Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution. If you can deduct all of the interest on your mortgage you may be able to deduct all of the points paid on the. Ad Ready To Apply.

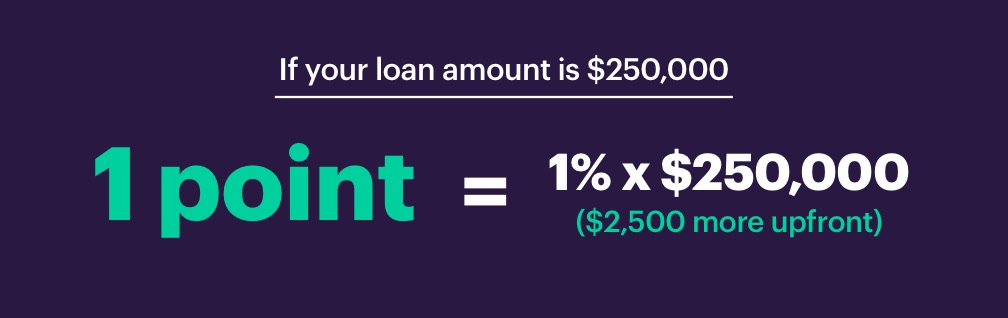

Web Mortgage points are prepaid interest on your home loan in order to get a reduced interest rate. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Our Experts Are Committed To Helping Customers Find Their Best Home Loan Solution.

Web Use Code Section Number 26 US. Theyre discount points see the definition The mortgage is used to. Code 461 - General rule for taxable year of deduction for the amortization of points.

Web Discount Points Deductions Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Well help you every step of the way via our new online application.

But not as a lump sum. Ad Shortening your term could save you money over the life of your loan. You can fully deduct mortgage points in the year you paid them if all of these apply.

Here are the specifics. Usually your lender will send you. Web Most homeowners can deduct all of their mortgage interest.

With a 30-year mortgage you deduct one-thirtieth of the cost of the points each year. Web Mortgage points are considered an itemized deduction and are claimed on Schedule A of Form 1040. Web Up to 96 cash back Deducting Mortgage Points in the Year Paid.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Youre using a cash method.

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Gpmtq32020investorpresen

Mortgage Points Deduction Itemized Deductions Houselogic

Deducting Home Mortgage Points How To How Much To Deduct Pocketsense

Are Mortgage Points Tax Deductible

Points Credits And How To Decide Better Mortgage Better Mortgage

Mortgage Points A Complete Guide Rocket Mortgage

Solved Joe Earns 39 000 Per Year And He S Paid Monthly His Monthly 401k Course Hero

Home Mortgage Loan Interest Payments Points Deduction

Home Mortgage Loan Interest Payments Points Deduction

:max_bytes(150000):strip_icc()/thinkstockphotos-178461378-5bfc3526c9e77c005878d646.jpg)

Getting A Mortgage After Bankruptcy And Foreclosure

31 Loan Agreement Templates Word Pdf Pages

Mortgage Discount Points Calculator Mortgage Calculator

Barney Labrador Welpen Tasse Tasse Matt Barneysshop

What Are Mortgage Points

Discount Points Explained For Your Mortgage Are They Worth It Youtube

What Are Mortgage Points